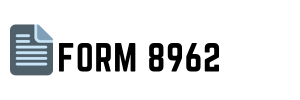

When it comes to filing taxes, understanding the structure of the necessary forms is crucial. The IRS Form 8962, or the Premium Tax Credit (PTC) form, is designed to calculate the amount of premium tax credit you're eligible for if you purchased health insurance through the Marketplace. The form includes several vital sections:

- Part I, wherein you fill in your Annual and Monthly Contribution Amounts, reflects the income percentage expected to be spent on insurance.

- Part II is where the actual Premium Tax Credit amount is computed, taking into account your family’s size and income.

- Part III determines the reconciliation of the premium tax credit, comparing what you've used in advance against what you actually qualify for.

- Part IV is where any shared policy allocations are reported for those who share a policy with someone not included on the same tax return.

This form is directly tied to the Affordable Care Act (ACA) and is key for anyone who's looking to receive or has received healthcare subsidies. Preparing the free IRS Form 8962 printable requires a careful review of the policy statements received from your health insurance provider and a good grasp of your household income.

Guidelines for Completing Form 8962 Accurately

To ensure that you fill out the printable form 8962 for 2023 correctly, consider the following tips:

- Have your Form 1095-A, the Health Insurance Marketplace Statement, at hand for reference.

- Double-check your calculations, especially when entering your household income and the percentage of income contributed to insurance premiums.

- Ensure all personal information matches what's on your tax return, including your Social Security Number and filing status.

- Use the correct figures from the 1095-A to report monthly premium amounts and any advance payments of the premium tax credit.

- If multiple taxpayers are sharing the policy costs, agree on how to allocate these amounts before filing.

Accurate and meticulous entry of data will minimize errors and potential delays in processing your tax return.

Step-by-Step Guide to Filing Form 8962

Once you've filled out your free 8962 printable form, here's how to incorporate it into your tax filing process:

- Complete your federal tax return forms up to the point of calculating your total tax liability.

- Add the information from Form 8962 to calculate your Premium Tax Credit and reconcile it with any advance payments you've received.

- Attach Form 8962 to your tax return. If you're filing electronically, follow the software prompts to include the form's data.

- Review the entire return to ensure all information is correct and that Form 8962 is properly included.

- Submit your tax return either through the e-filing process or by mailing it to the IRS if you're filing a paper return.

Whether you e-file or mail your tax return, including the completed printable IRS Form 8962 for 2023 is a crucial step for those who received health insurance through the Marketplace.

Deadline for Filing Form 8962

The deadline to file Form 8962 coincides with your federal tax return deadline. For most taxpayers, this is typically April 15 of the year following the tax year. If April 15 falls on a weekend or a holiday, the deadline will be the next business day. It's important always to check for any updates or extensions to the filing deadlines by the IRS each year.

By understanding the structure, carefully completing the form, and meeting the filing deadline, you'll ensure that your Premium Tax Credit is accurately calculated and reconciled, providing you with the correct subsidy or refund due. Remember to keep a copy of your free printable 8962 tax form for your records once filed.

Printable IRS Form 8962

Printable IRS Form 8962

IRS 8962 Form Instructions

IRS 8962 Form Instructions