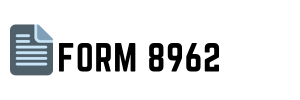

Do you find yourself scratching your head when tax season rolls around, especially when dealing with health insurance premiums? If so, Form 8962 might be a crucial piece of the puzzle. Rather than a dreadful chore, consider it a potential pathway to savings, specifically if you've benefited from the Premium Tax Credit (PTC). The PTC is a boon for individuals and families with moderate incomes who purchase health insurance through the Health Insurance Marketplace. It aims to make health coverage more affordable by providing a tax credit. Form 8962 comes into play as the means through which you can reconcile the amount of credit you're entitled to. Our article is simplified instructions for IRS Form 8962 for those who need assistance.

IRS Tax Form 8962 Correctly: A How-To Guide

Filling out IRS 8962 form instructions can seem daunting, but with a careful approach, it's entirely manageable. Here are some key points to help guide you through the process:

- Verify Your Marketplace Statement

Before diving into Form 8962, ensure you have your Form 1095-A and your Health Insurance Marketplace Statement. It contains vital information needed to determine your PTC. - Accurately Report Household Income

When you apply for the credit, you estimate your income for the year; it's now time to reconcile that estimate with your actual household income. - Know Your Family Size

Your household size can influence your credit amount, so include everyone you claim as a dependent on your tax return. - Understand the Allocation Situation

If you're sharing a policy with someone else or are divorced and sharing the credit, you’ll need to decide how to allocate the policy amounts. - Calculate Your Credit

Form 8962 will guide you through calculating the total premium tax credit to which you're entitled, as well as the amount you've already used.

It's critical to read the instructions for tax form 8962 thoroughly. They contain essential information in the form's sections, from the Annual and Monthly Contribution Amount to the Premium Tax Credit Claim and Reconciliation of Advance Payment of PTC.

Completing Form 8962 Without Pitfalls

While the IRS tax form 8962 instructions are comprehensive, taxpayers sometimes make mistakes. Here are some common errors and tips to avoid them:

- Mismatched Information

All information on Form 8962 must match the details on the 1095-A copy. Double-check figures, especially the policy number and the SLCSP (Second Lowest Cost Silver Plan) amount. - Incorrect Household Size

Any discrepancies in household size can affect your credit. Make sure you include all applicable dependents as per your tax return. - Failing to File

If you've benefited from advance payments of the Premium Tax Credit, you must file Form 8962. Failing to do so may make you ineligible for advance payments in the future. - Misunderstanding Reconciliation

This form reconciles advance payments with the amount of credit you're eligible for. Ensure you understand how to reflect any differences properly. - Evasion of Allocations

If you need to allocate policy amounts with another individual, don't overlook this process, as it can complicate your credit amount.

Ensuring you follow the 8962 tax form instructions methodically will smooth out the often-tricky terrain of tax filings. As always, if you're uncertain or overwhelmed, don't hesitate to garner the assistance of a tax professional who can bring clarity and confidence to your tax preparation efforts. And remember, paying meticulous attention to detail now can prevent headaches and keep your finances in prime shape come tax time.

Printable IRS Form 8962

Printable IRS Form 8962

IRS 8962 Form Instructions

IRS 8962 Form Instructions