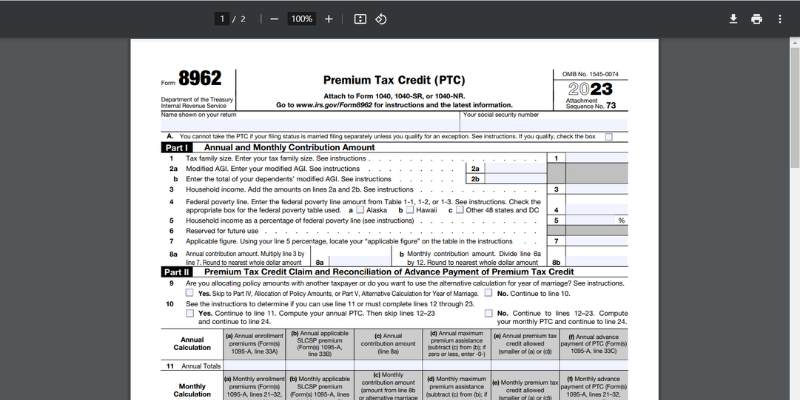

IRS Form 8962 is a crucial document that taxpayers must utilize to properly calculate their Premium Tax Credit (PTC), an essential financial aid for those purchasing insurance through the marketplace. Accurately completing this form ensures you pay the correct amount to the IRS or receive the appropriate credit toward your health insurance premiums if you are eligible. Simply put, the IRS tax form 8962 for 2023 reconciles the amount of PTC you're entitled to with any advance payments already made to your insurer.

Our website, 8962form2023.com, is an invaluable resource for anyone navigating the complexities of this document. It offers a comprehensive set of materials, including the 2023 Form 8962 with instructions in PDF, which can significantly simplify the process. With detailed examples and step-by-step guidance, taxpayers can confidently prepare their federal form 8962, minimizing errors and ensuring compliance with the latest fiscal regulations. By leveraging these resources, individuals can accurately calculate and claim the Premium Tax Credit, thus potentially easing their financial burden.

Obligation to File IRS 8962 Form for 2023

Individuals who obtained health insurance coverage through the Marketplace and benefitted from advance payments of the PTC must complete the federal tax form 8962 for 2023 on time. Accurate completion and submission of this form are critical for reconciling the amount of credit received with the actual premium tax credit eligibility for the fiscal year.

Eligibility requirements to fill out Form 8962 for 2023 are straightforward. If you have received a 1095-A copy detailing insurance purchased through the Marketplace, filing Form 8962 with your tax return is necessary. Here’s a succinct list of exceptions where submitting this form may not apply:

- Taxpayers who did not enroll in health coverage via the Marketplace.

- Those who elected not to receive advance credit payments.

- Individuals who are included in another person’s tax return.

- Tax filers whose household income falls below the threshold requiring a federal return.

Adherence to these guidelines ensures compliance with IRS standards and helps avoid processing delays. Understanding when to use IRS Form 8962: Premium Tax Credit for 2023 is vital for taxpayers claiming those benefits. For convenience, you may download the blank template or opt to fill it out online directly on our website.

Instructions to Fill Out the 8962 Tax Form

To accurately complete the document, you need to get IRS Form 8962 instructions for 2023 in PDF, which will serve as a comprehensive guide through each process stage. Next, locate a blank Form 8962 on our website, ensuring you have the correct version for the current tax year. Carefully read the available instructions and familiarize yourself with the form's requirements to avoid common mistakes.

Proceed to fill out Form 8962 online, utilizing the tools provided on our website to enter information directly into the fillable fields. here are the key fillable fields on Form 8962:

- Column (a): Monthly amounts for the applicable SLCSP (Second Lowest Cost Silver Plan) for each individual.

- Column (b): Monthly contribution amount.

- Column (c): Premium assistance amount for the month.

- Lines 1-11: These lines are used to calculate the annual and monthly premium assistance amounts, taking into account changes in income, family size, and coverage.

- Line 12: Repayment limitation based on income.

- Lines 13-23: These lines calculate the excess advance premium tax credit repayment, if applicable.

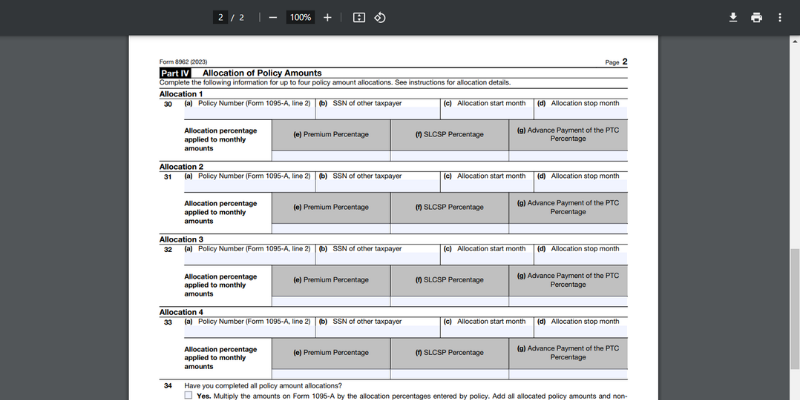

- Lines 24-35: Used if multiple taxpayers are covered under the same policy, allocating the policy amounts among the individuals.

- Lines 36-41: Used if the taxpayer was married during the tax year and is filing separately, and certain conditions apply.

- Lines 42-46: Applicable if the taxpayer resides in a community property state.

- Lines 47-54: Used to allocate premium amounts for individuals covered for a portion of the year due to certain qualifying events.

- Lines 55-61: Used to calculate the premium tax credit for individuals with short coverage gaps.

Make sure to consult the Double-check your entries against the information reported to you on Form 1095-A to ensure all data is correctly transferred. Finally, review your sample thoroughly for accuracy before submitting it to the IRS.

Due Date for 2023 Form 8962

For individuals preparing their taxes for the fiscal year 2023, IRS Form 8962 printable is a critical document reconciling premium tax credits for health insurance purchased through the marketplace. The due date for filing this form aligns with the standard tax return deadline, which stands on April 15th, unless it falls on a weekend or holiday, in which case it's the next business day. This date is mandated to consolidate the processing of various tax-related forms and ensure the correct premium tax credit is applied.

As the copy is available for download, you can access a tax form 8962 printable for 2023 from our website to review and complete the necessary information. If you cannot meet the April 15 deadline, you can file for an extension, giving you until October 15th to submit your forms, including the 8962. To avoid any penalties, requesting an extension by the original due date of your tax return is advisable.

IRS 8962 Form in PDF to Fill Out Online

IRS 8962 Form in PDF to Fill Out Online

Form 8962 - Premium Tax Credit

Form 8962 - Premium Tax Credit

Form 8962 Instructions

Form 8962 Instructions

Printable IRS Form 8962

Printable IRS Form 8962

IRS 8962 Form Instructions

IRS 8962 Form Instructions